Today Singapore's market traded 2,598,936,018 shares with total value of S$ 2,380,041,363 was exceptionally high.

Many wondered why Noble Group (N21) and Sembcorp Marine (S51) price dropped with very high volume 1,230,282,900 shares and 85,172,600 shares traded respectively during the closing stage of the market. SATS (S58) closing volume of 78,542,700 shares was also very high.

The volatility near market closing was due to the MSCI (Morgan Stanley Capital International) Global Investable Market Indexes November 2016 Semi-Annual Index Review done at the close of market today.

https://www.msci.com/index-review

Under the MSCI Global Standard Indexes, SATS was added while Noble Group and Semcorp Marine was deleted. This explains why the price of SATS closed 0.8% higher while the price of Noble was down 7.6% and Sembcorp Marine were down 5.7%.

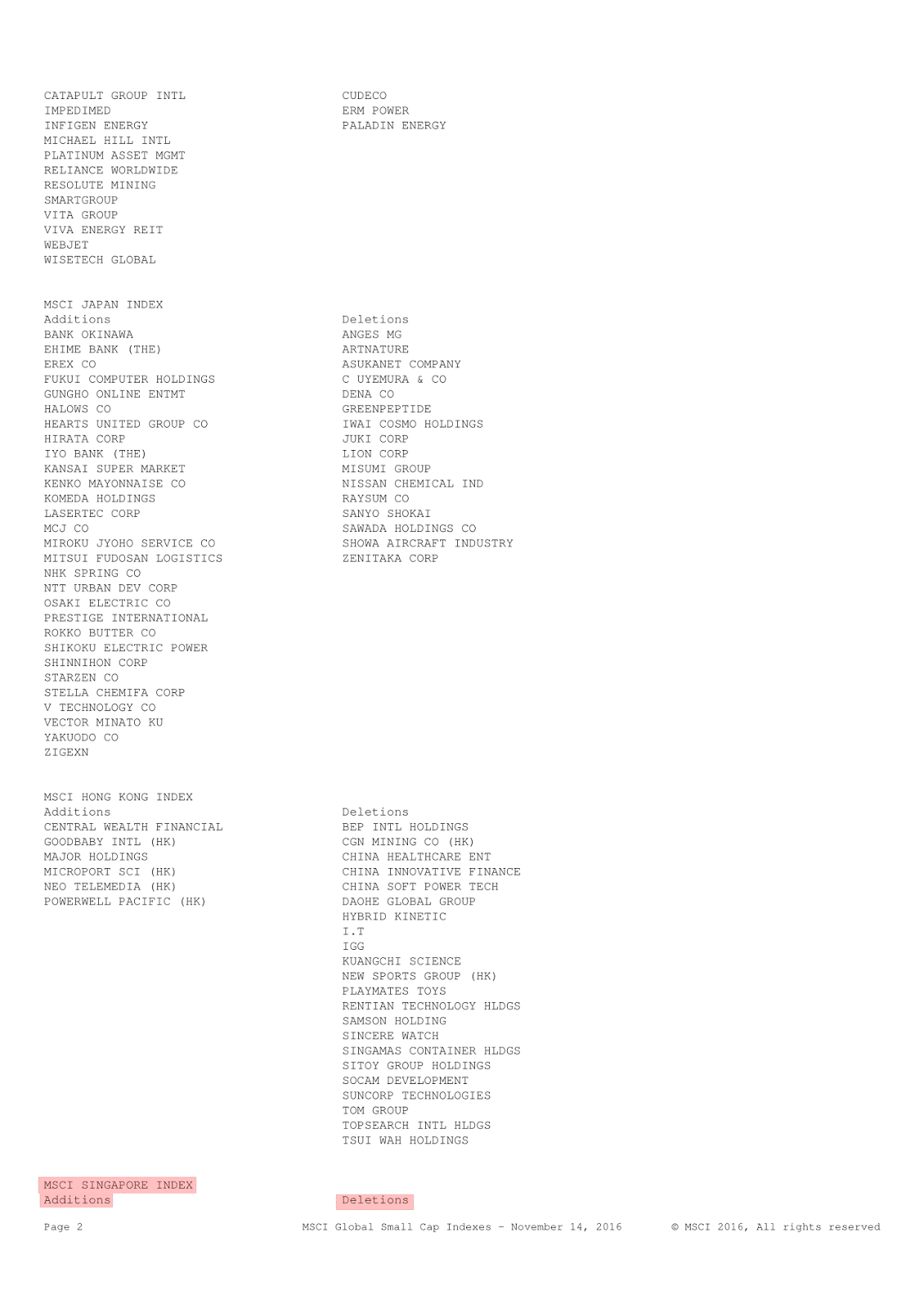

As for MSCI Global Small Cap Indexes, there were 4 securities added and 9 were deleted.

The securities added were Frasers Logistics & Industrial, Manulife US Reit, Noble Group and Semcorp Marine.

The securities deleted were AIMS AMP Capital Industrial, Frasers Hospitality Trust, Ho Bee Land, Hong Fok Corp, PACC Offshore Svcs Hldgs, Perennial Real Estate Hldg, Rowsley, SATS and Tat Hong Holdings.

No comments:

Post a Comment