Today Singapore's market traded 2,598,936,018 shares with total value of S$ 2,380,041,363 was exceptionally high.

Many wondered why Noble Group (N21) and Sembcorp Marine (S51) price dropped with very high volume 1,230,282,900 shares and 85,172,600 shares traded respectively during the closing stage of the market. SATS (S58) closing volume of 78,542,700 shares was also very high.

The volatility near market closing was due to the MSCI (Morgan Stanley Capital International) Global Investable Market Indexes November 2016 Semi-Annual Index Review done at the close of market today.

https://www.msci.com/index-review

Under the MSCI Global Standard Indexes, SATS was added while Noble Group and Semcorp Marine was deleted. This explains why the price of SATS closed 0.8% higher while the price of Noble was down 7.6% and Sembcorp Marine were down 5.7%.

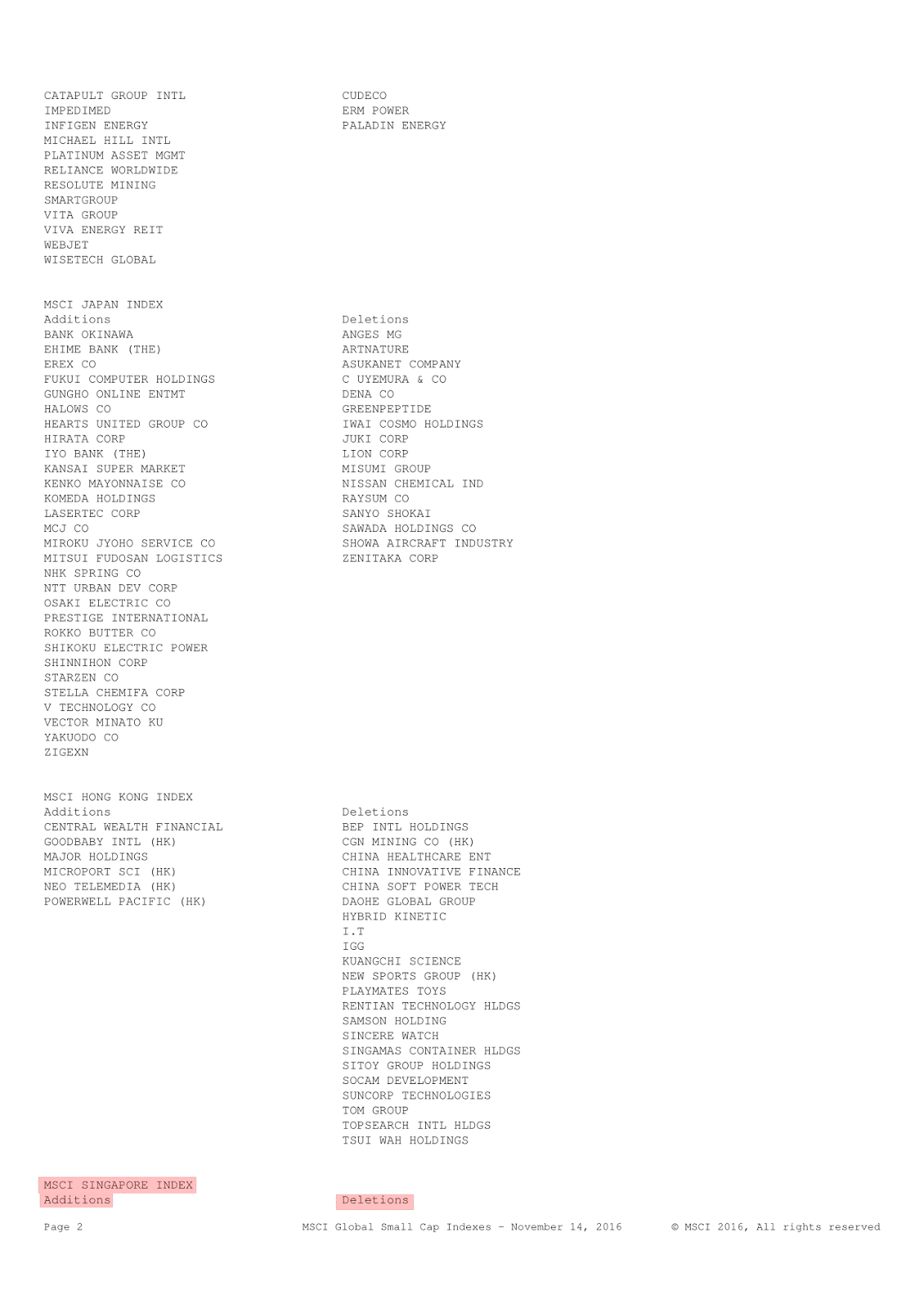

As for MSCI Global Small Cap Indexes, there were 4 securities added and 9 were deleted.

The securities added were Frasers Logistics & Industrial, Manulife US Reit, Noble Group and Semcorp Marine.

The securities deleted were AIMS AMP Capital Industrial, Frasers Hospitality Trust, Ho Bee Land, Hong Fok Corp, PACC Offshore Svcs Hldgs, Perennial Real Estate Hldg, Rowsley, SATS and Tat Hong Holdings.

Wednesday, 30 November 2016

Sunday, 27 November 2016

Jumbo (42R) - 25 Nov 2016

JUMBO Group FY16 profit jumps 46.3%

Technically Jumbo is on an uptrend. Resistance is at $0.670 and next resistance level is at $0.680.

Support is currently at $0.655 and next support level is at $0.640.

Tuesday, 22 November 2016

ThaiBev (Y92) - 22 Nov 2016

ThaiBev’s dampened spirits

Tuesday, 15 November 2016

Sembcorp Marine (S51) - 15 Nov 2016

SembMarine to sell 30% stake in Cosco Shipyard for 1.06b yuan

Apart from improving liquidity, this divestment also removes any overhang of further write-downs/ losses to be incurred at the associate level.

The weekly chart of Sembcorp Marine show that it is on a gradual up-trend.

The current technical support for Sembcorp Marine is at $1.31 and next support is at $1.23/

Near-term resistance is at $1.36 and next level is at $1.40.

Thursday, 10 November 2016

SingTel (Z74) - 10 Nov 2106

Singtel's Q2 net profit falls 5.6% without Airtel's exceptional gains seen a year ago

SingTel weekly charts shows that the current support is at $3.81 and the next support is at $3.73.

The resistance is at $3.86 and next level of resistance is at $3.90.

Wednesday, 9 November 2016

CapitaLand (C31) - 09 Nov 2016

CapitaLand's 3Q profits soared 28.4% to $247.5m.

http://sbr.com.sg/residential-property/news/capitalands-3q-profits-soared-284-2475m

Using the weekly chart, CapitaLand is currently trading between $3.03 to $3.26.

The current support is at $3.03 and $2.94.

The resistance levels are at $3.10 and $3.15.

Monday, 7 November 2016

SingPost (S08) - 07 Nov 2016

SingPost's net profit down 41.2% to $31.4m.

http://sbr.com.sg/transport-logistics/news/singposts-net-profit-down-412-314m

SingPost weekly technical chart shows up-trend started in Aug 2016 but today's closing price at $1.535 may break this trend.

The technical support is currently at $1.53 and the next support is at $1.49.

The resistance levels are at $1.58 and a strong resistance is at $1.65.

StarHub (CC3) - 07 Nov 2016

StarHub loses 11,000 payTV subscribers.

http://sbr.com.sg/transport-logistics/news/starhub-loses-11000-paytv-subscribers

StarHub technical chart shows that it is still down-trend.

The current support is at $3.17 and next support is at $3.14.

Resistance is currently at $3.21 and $3.26.

Sunday, 6 November 2016

SIA (C6L) - 04 Nov 2016

SIA’s 2Q earnings fall 70% to $65 mil on weak operating numbers.

SIA weekly chart shows that is is on a weekly down-trend.

Current technical support levels are at $9.91 and $9.80.

The resistance is currently at $10.10 and $10.27.

Subscribe to:

Comments (Atom)