Monday, 12 December 2016

SIA (C6L) - 12 Dec 2016

Singapore Airlines Wants to Be a Budget Carrier, Too

Squeezed by rivals, the luxury airline plots a course for heavy growth and new revenue streams.

https://www.bloomberg.com/news/articles/2016-12-12/singapore-airlines-wants-to-be-a-budget-carrier-too

SIA technical chart show some price support at $9.67 and $9.60 after a long down-trend since mid-August 2106.

The price resistance levels are $9.80 and $9.86.

Tuesday, 6 December 2016

Noble (N21) - 06 Dec 2016

Noble Group ditches stakes in 4 UK power firms for $33m http://sbr.com.sg/utilities/news/noble-group-ditches-stakes-in-4-uk-power-firms-33m#sthash.CsWKZlNa.dpuf

The weekly chart of Noble shows that it is trading in a range between $0.160 and $0.195. However, this range is a swing of about 21.88% which is a decent trading range.

The current support is at $0.161 and $0.152.

The resistance levels are $.175 and $0.192.

Wednesday, 30 November 2016

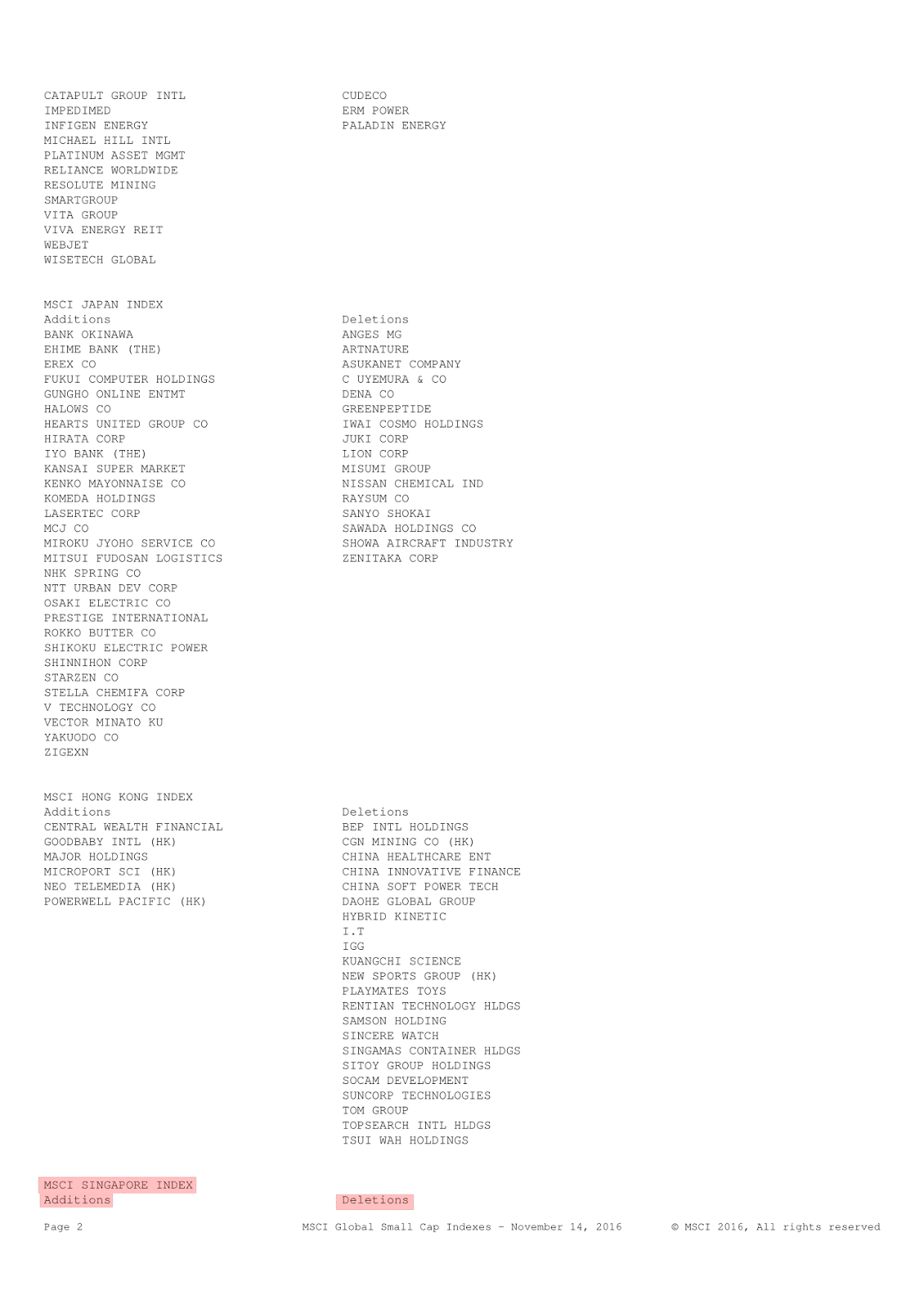

MSCI Global Investable Market Indexes November 2016 Semi-Annual Index Review - 30 Nov 2016

Today Singapore's market traded 2,598,936,018 shares with total value of S$ 2,380,041,363 was exceptionally high.

Many wondered why Noble Group (N21) and Sembcorp Marine (S51) price dropped with very high volume 1,230,282,900 shares and 85,172,600 shares traded respectively during the closing stage of the market. SATS (S58) closing volume of 78,542,700 shares was also very high.

The volatility near market closing was due to the MSCI (Morgan Stanley Capital International) Global Investable Market Indexes November 2016 Semi-Annual Index Review done at the close of market today.

https://www.msci.com/index-review

Under the MSCI Global Standard Indexes, SATS was added while Noble Group and Semcorp Marine was deleted. This explains why the price of SATS closed 0.8% higher while the price of Noble was down 7.6% and Sembcorp Marine were down 5.7%.

As for MSCI Global Small Cap Indexes, there were 4 securities added and 9 were deleted.

The securities added were Frasers Logistics & Industrial, Manulife US Reit, Noble Group and Semcorp Marine.

The securities deleted were AIMS AMP Capital Industrial, Frasers Hospitality Trust, Ho Bee Land, Hong Fok Corp, PACC Offshore Svcs Hldgs, Perennial Real Estate Hldg, Rowsley, SATS and Tat Hong Holdings.

Many wondered why Noble Group (N21) and Sembcorp Marine (S51) price dropped with very high volume 1,230,282,900 shares and 85,172,600 shares traded respectively during the closing stage of the market. SATS (S58) closing volume of 78,542,700 shares was also very high.

The volatility near market closing was due to the MSCI (Morgan Stanley Capital International) Global Investable Market Indexes November 2016 Semi-Annual Index Review done at the close of market today.

https://www.msci.com/index-review

Under the MSCI Global Standard Indexes, SATS was added while Noble Group and Semcorp Marine was deleted. This explains why the price of SATS closed 0.8% higher while the price of Noble was down 7.6% and Sembcorp Marine were down 5.7%.

As for MSCI Global Small Cap Indexes, there were 4 securities added and 9 were deleted.

The securities added were Frasers Logistics & Industrial, Manulife US Reit, Noble Group and Semcorp Marine.

The securities deleted were AIMS AMP Capital Industrial, Frasers Hospitality Trust, Ho Bee Land, Hong Fok Corp, PACC Offshore Svcs Hldgs, Perennial Real Estate Hldg, Rowsley, SATS and Tat Hong Holdings.

Sunday, 27 November 2016

Jumbo (42R) - 25 Nov 2016

JUMBO Group FY16 profit jumps 46.3%

Technically Jumbo is on an uptrend. Resistance is at $0.670 and next resistance level is at $0.680.

Support is currently at $0.655 and next support level is at $0.640.

Tuesday, 22 November 2016

ThaiBev (Y92) - 22 Nov 2016

ThaiBev’s dampened spirits

Tuesday, 15 November 2016

Sembcorp Marine (S51) - 15 Nov 2016

SembMarine to sell 30% stake in Cosco Shipyard for 1.06b yuan

Apart from improving liquidity, this divestment also removes any overhang of further write-downs/ losses to be incurred at the associate level.

The weekly chart of Sembcorp Marine show that it is on a gradual up-trend.

The current technical support for Sembcorp Marine is at $1.31 and next support is at $1.23/

Near-term resistance is at $1.36 and next level is at $1.40.

Thursday, 10 November 2016

SingTel (Z74) - 10 Nov 2106

Singtel's Q2 net profit falls 5.6% without Airtel's exceptional gains seen a year ago

SingTel weekly charts shows that the current support is at $3.81 and the next support is at $3.73.

The resistance is at $3.86 and next level of resistance is at $3.90.

Wednesday, 9 November 2016

CapitaLand (C31) - 09 Nov 2016

CapitaLand's 3Q profits soared 28.4% to $247.5m.

http://sbr.com.sg/residential-property/news/capitalands-3q-profits-soared-284-2475m

Using the weekly chart, CapitaLand is currently trading between $3.03 to $3.26.

The current support is at $3.03 and $2.94.

The resistance levels are at $3.10 and $3.15.

Monday, 7 November 2016

SingPost (S08) - 07 Nov 2016

SingPost's net profit down 41.2% to $31.4m.

http://sbr.com.sg/transport-logistics/news/singposts-net-profit-down-412-314m

SingPost weekly technical chart shows up-trend started in Aug 2016 but today's closing price at $1.535 may break this trend.

The technical support is currently at $1.53 and the next support is at $1.49.

The resistance levels are at $1.58 and a strong resistance is at $1.65.

StarHub (CC3) - 07 Nov 2016

StarHub loses 11,000 payTV subscribers.

http://sbr.com.sg/transport-logistics/news/starhub-loses-11000-paytv-subscribers

StarHub technical chart shows that it is still down-trend.

The current support is at $3.17 and next support is at $3.14.

Resistance is currently at $3.21 and $3.26.

Sunday, 6 November 2016

SIA (C6L) - 04 Nov 2016

SIA’s 2Q earnings fall 70% to $65 mil on weak operating numbers.

SIA weekly chart shows that is is on a weekly down-trend.

Current technical support levels are at $9.91 and $9.80.

The resistance is currently at $10.10 and $10.27.

Monday, 31 October 2016

DBS (D05) - 31 Oct 2016

DBS Q3 net profit at S$1.071b, buys ANZ's wealth, retail units in 5 Asian countries.

DBS weekly chart show that the current support is at $14.89 and $14.53.

Technical resistance is at $15.11 and next level is at $15.29.

Sunday, 30 October 2016

UOB (U11) - 28 Oct 2016

UOB’s 3Q earnings fall 7.8% to $791 mil on absence of one-off gain, higher allowances.

UOB weekly technical charts shows trading range between $18.15 and about $19.00 for the past 8 weeks.

The current resistance is at $18.93 and support at $18.60.

OCBC Bank (O39) - 28 Oct 2016

OCBC Q3 earnings up 5%, beating forecasts, but asset quality remains stressed.

From the weekly technical chart, OCBC is trading between about $8.38 to $8.70 range.

Current support is at $8.40 and next support at $8.30

Technical resistance is at $8.48 and $8.56.

Thursday, 27 October 2016

Sembcorp Ind (U96) - 27 Oct 2016

Sembcorp Q3 profit falls 56% as all divisions but utilities turn red.

Marine, offshore engineering businesses hit; but utilities division posts 21% profit gain

From the weekly chart, Sembcorp Ind is on a weekly down-trend. A breakout from this line will signal a reversal in trend.

Price support is at $2.45 and next support is at $2.39.

The price resistance is at and $2.54 and next level of resistance is at $2.62.

Tuesday, 25 October 2016

Sembcorp Marine (S51) - 25 Oct 2016

Sembcorp Marine sank into a 3Q16 net loss of $21.8m from $32.1m profit in 3Q15.

http://www.businesstimes.com.sg/companies-markets/sembmarine-plunges-into-the-red-for-q3

The technical support for Sembcorp Marine is at $1.290 and $1.265.

Technical resistance is at $1.305 and $1.325.

Thursday, 20 October 2016

Keppel Corp (BN4) - 20 Oct 2016

Keppel Corp Q3 gains down 38%, plans more layoffs at O&M unit.

http://www.businesstimes.com.sg/companies-markets/keppel-corp-q3-gains-down-38-plans-more-layoffs-at-om-unit

The weekly technical chart of Keppel Corp shares shows it is trading between $5.15 and $5.53 since late May till today.

Unless it is able to break the resistance with high volume, the share will trade in this range for awhile.

Tuesday, 18 October 2016

M1 (B2F) - 18 Oct 2016

M1's 3Q earnings fall 23.4% to $34.4 million on lower operating revenue.

http://www.theedgemarkets.com.sg/sg/article/m1%E2%80%99s-3q-earnings-fall-234-344-mil-lower-operating-revenue

The technical chart of M1 shows that it is on a down-trend since 18 Aug 2016.

The technical support based on current price is at $2.18 and a strong support is at about $2.10.

The price resistance is at $2.26 and $2.33.

Saturday, 15 October 2016

Straits Times Index (STI) - The Week Ahead 17 to 21 Oct 2016

Corporate earnings, economic reports and Fed speakers could all challenge markets in the week ahead, but traders will be on guard for the latest catalyst — the potential bombshells coming from the presidential election.

http://www.cnbc.com/2016/10/14/take-your-pick-theres-a-lot-that-could-spin-markets-in-week-ahead.html

The STI weekly chart shows that the current support is at about 2800 points and next support is at 2720 points.

The resistance is at 2835 and 2860 points.

Sunday, 9 October 2016

Hyflux (600) - 07 Oct 2016

PUB is expected to unveil the winner of a $400-500m tender for the construction of Singapore's fourth desalination plant. The six contenders are SGX-listed Hyflux, United Engineers, Sembcorp Industries and Keppel Corp, as well as China-linked MCC Land and Spain's Tedagua.

http://asia.nikkei.com/Business/Companies/Singapore-looks-to-build-fourth-desalination-plant

Technically, Hyflux has bottomed from the support at $0.470 with high volume for the past two trading sessions.

From the chart, it seems to have more upside opportunity than downside.

Current technical resistance is at $0.500 and next resistance at $0.510. The major resistance is at $0.520.

Technical support is at $0.495 and $0.485.

Wednesday, 28 September 2016

Jumbo (42R) - 29 Sep 2016

Maybank Kim Eng downgrade Sheng Siong from BUY to HOLD with just 5% upside to SGD1.13 TP, and upgrade Jumbo from HOLD to BUY with 40% upside to the revised TP of SGD0.78. In the seasonally stronger 4Q, stocks that do better such as Jumbo should outperform defensive stocks such as Sheng Siong, which typically see weaker sales. On top of that, valuations favour Jumbo and positive catalysts await it as well. But Sheng Siong could face neutral to negative developments.

Technically, on 26 Sep 2016, Jumbo exhibits a hammer and the price closed at $0.565 support. http://www.investopedia.com/terms/h/hammer.asp

This was followed by a price gain of $0.025 the next day with big volume the next trading day.

Today, Jumbo exhibits a doji with immediate resistance at $0.605. The next resistance will be the 50 day-Moving Average of $0.620.

http://www.investopedia.com/terms/d/doji.asp

Monday, 12 September 2016

Straits Times Index (STI) - The Week Ahead

Down Jones on 09 Sep 2016 closed 394.46 points lower on 09 Sep 2016 and shares in Europe and Asia dropped the most since the aftermath of the U,K. Brexit vote in June after Fed Bank of Boston President Eric Rosengren said the economy could overheat.

Singapore market is closed today for Hari Raya Haji holiday. The Straits Times Index (STI) is likely to fall about 2% tomorrow when it opens.

In my point of view, markets have recovered very quickly after the Brexit vote and finding an excuse to sell off. It will be good opportunity to buy blue chips shares when the sell-off is done.

The important support for STI will be the 200-day Moving Average at about 2,800 points. If it breaks the 200-day MA, the next support will be at 2,770 and 2,720.

Sunday, 4 September 2016

SingTel (Z74), StarHub (CC3) and M1 (B2F)

Telco shares fell on 02 Sep 2016 amid bids for 4th player.

http://www.straitstimes.com/business/companies-markets/telco-shares-fall-amid-bids-for-4th-player

This could be a buying opportunity as SingTel, StarHub and M1 shares are defensive. They provide yield between 4.4% to 6.1%.

Should the bids for 4th telco are not successful, these stocks should stage a rebound.

Here are the technical analysis for the stocks.

SingTel (Z74) Technical Resistance: $3.89 and $3.97

SingTel (Z74) Technical Support : $3.84 and $3.75

StarHub (CC3) Technical Resistance: $3.51 and $3.55

StarHub (CC3) Technical Support: $3.47 and $3.43

M1 (B2F) Technical Resistance: $2.52 and $2.55.

M1 (B2F) Technical Support: $2.49 and $2.46.

http://www.straitstimes.com/business/companies-markets/telco-shares-fall-amid-bids-for-4th-player

This could be a buying opportunity as SingTel, StarHub and M1 shares are defensive. They provide yield between 4.4% to 6.1%.

Should the bids for 4th telco are not successful, these stocks should stage a rebound.

Here are the technical analysis for the stocks.

SingTel (Z74) Technical Resistance: $3.89 and $3.97

SingTel (Z74) Technical Support : $3.84 and $3.75

StarHub (CC3) Technical Resistance: $3.51 and $3.55

StarHub (CC3) Technical Support: $3.47 and $3.43

M1 (B2F) Technical Resistance: $2.52 and $2.55.

M1 (B2F) Technical Support: $2.49 and $2.46.

Sunday, 28 August 2016

Sheng Siong (OV8) and Diary Farm (D01) - 26 Aug 2016

Under the consumer sector, Dairy Farm and Sheng Siong are the listed supermarkets in Singapore.

The technical resistance for Dairy Farm is currently at US$7.26 and next resistance is at US$7.35.

Price is support is at US$7.18 and US$7.12

I noticed over the weekend that the Cold Storage supermarket at Changi City Point has closed its outlet and the Giant supermarket at Suntec seems to be down-sizing.

The two charts below shows the technical support and resistance of Dairy Farm and Sheng Siong after the recent profit-taking after recent highs.

The technical resistance for Dairy Farm is currently at US$7.26 and next resistance is at US$7.35.

Price is support is at US$7.18 and US$7.12

The technical support for Sheng Siong is at $1.04 and next price support is at $1.02.

The resistance is at $1.05 and $1.07.

Monday, 22 August 2016

Wing Tai (W05) - 22 Aug 2016

Wing Tai posted a net profit of S$1.88 million for the fourth quarter ended June 30, 2016.

Declared final and special DPS totalling 6¢ (FY15: 3¢). NAV/share at $4.04.

http://www.businesstimes.com.sg/companies-markets/wing-tais-q4-net-profit-dives

The technical price support is at $1.765 and next support is at $1.750.

The price resistance is at $1.790 and next resistance is $1.815.

Tuesday, 16 August 2016

Global Logistic (MC0) - 16 Aug 2016

Technical charts shows that the current support for Global Logistic is at $1.895 and the next support is at $1.875.

The price resistance is at $1.925 and $1.965.

Monday, 15 August 2016

First Resources (EB5) - 15 Aug 2016

Will First Resources’ H2 profits wither in line with its waning output? - See more at: http://sbr.com.sg/agribusiness/news/will-first-resources%E2%80%99-h2-profits-wither-in-line-its-waning-output#sthash.3cWCAW0P.dpuf

First Resources closed at $1.705 with good volumes on 15 Aug 2016.

The next resistance is at $1.80 which is also the 200-day Moving Average.

Th current price support is at $1.695.

ST Engineering (S63) - 15 Aug 2016

ST Engineering’s net profit barely inches up by 2% to $127m in 2Q - See more at: http://sbr.com.sg/building-engineering/news/st-engineering%E2%80%99s-net-profit-barely-inches-2-127m-in-2q#sthash.Me4WgxtO.dpuf

ST Engineering closed below the 20-day Moving Average on 15 Aug 2016 at $3.34.

The current price support is at $3.29 and $3.24.

The resistance levels are at $3.36 and $3.43.

Thursday, 11 August 2016

Noble (N21) - 11 Aug 2016

Noble Group sunk into 2Q16 with net loss of US$54.9 million.

http://www.theedgemarkets.com.sg/sg/article/noble-sinks-us55-mil-loss-2q

The technical chart shows that the current support is at $0.151 and next support is at $0.146.

The resistance is currently at $0.157 and $0.164.

Wednesday, 10 August 2016

SingTel (Z74) - 11 Aug 2016

SingTel posted a 0.3% increase in its net profit for Q1 to S$944.3 million.

http://www.businesstimes.com.sg/companies-markets/singtels-q1-profit-steady-revenue-dips

Current technical resistance is at $4.21 and $4.26

The price support is at $4.15 and $4.06.

Sunday, 7 August 2016

DBS (D05) - 08 Aug 2016

DBS 2Q profit drops 6% to $1.05 billion. This was in line with estimates.

http://www.theedgemarkets.com.sg/sg/article/dbss-2q-profit-drops-6-bad-debt-charges-more-double

DBS is currently trading at P.E. 8.51 while OCBC is trading at P.E. 8.89 and UOB P.E. is at 9.33.

Technically, DBS share price is supported at $14.90 and $14.63.

Current price resistance is at $15.07 and $15.21.

Thursday, 4 August 2016

CapitaLand (C31) - 04 Aug 2016

CapitaLand Q2 net profit down 36.6% from a year ago to S$294 million, dragged by higher cost of sales and lower fair value gains of investment properties.

http://www.businesstimes.com.sg/companies-markets/capitaland-q2-net-profit-down-366

The technical chart shows that the current price resistance is at $3.20 and next resistance is at $3.24.

The price support is at $3.13 and $3.07.

Wednesday, 3 August 2016

StarHub (CC3) - 03 August2016

StarHub posts 9.6% jump in profit for Q2 but EBITDA was lower by 1.3 per cent year on year (yoy) at S$192 million. http://www.businesstimes.com.sg/companies-markets/starhub-posts-96-jump-in-profit-for-q2

Technically, StarHub is on up-trend but it is currently trading side-ways with strong resistance at $3.96 and $3.92.

The technical support is at $3.87 and $3.79.

Tuesday, 2 August 2016

Sembcorp Ind (U96) - 03 Aug 2016

Sembcorp Industries Q2 earnings plunge 61.3%. http://www.businesstimes.com.sg/companies-markets/sembcorp-industries-q2-earnings-plunge-613

Technically, Sembcorp Ind share price is supported at about $2.70 and the next support is at $2.60.

The current price resistance is at $2.77 and $2.82.

The stock has been trading in a range between $2.70 and $2.87 most of the time.

Sunday, 31 July 2016

Swiber (BGK) - Lessons from Swiber

Swiber has placed itself into judicial management instead of liquidation. http://www.businesstimes.com.sg/companies-markets/swiber-withdraws-liquidation-move

What are the warning signs to look out for?

http://www.straitstimes.com/business/companies-markets/swibers-woes-warning-signs-were-there-for-some-time

On 8 July 2016, Swiber announced that the Group has outstanding letters of demand for an aggregate amount of US$4.76 million. It also announced that completion of its US$710 million offshore field project in West Africa will be delayed owing to "weakness in the oil and gas sector".

On 11 July 2016, London-based private equity firm AMTC did not subscribe to US$200 million preference shares in its wholly owned unit Swiber Investment.

On 25 July 2016, responding to queries from SGX, Swiber says it faces US$15.2 million in total for outstanding letters of demand.

Technically, the spike in trading volume from 11 July 2016 following by a steep-down trend in the share prices showed that someone is offloading the shares.

My 5 Important Trading Rules:

1. The trend is your friend

2. Do not let profits turn into losses

3. Let profits develop and cut losses short

4. Set a stop loss on each and every trade

5. Trade when technical and fundamentals agree

Friday, 29 July 2016

SIA (C6L) - 29 July 2016

Singapore Air warns of tougher days after 181% profit jump.

http://www.todayonline.com/singapore/singapore-air-warns-tougher-days-after-181-profit-jump

The stock broke the up-trend line after the financial result announcement as passenger yields declined to their lowest in more than six years in he first quarter.

Technically, the support for SIA is $10.89 and the next support is at $10.76.

It closed below the 100-day and 200-day Moving Average with high volume. Immediate resistance is at $11.04 and $11.13. The $11.20 resistance will be a strong resistance as it fails to break it for four trading days before the result announcement.

Currently there is a limited price upside for SIA.

SIA (C6L) - 29 July 2016

Singapore Air warns of tougher days after 181% profit jump.

http://www.todayonline.com/singapore/singapore-air-warns-tougher-days-after-181-profit-jump

The stock broke the up-trend line after the financial result announcement as passenger yields declined to their lowest in more tan six years in he first quarter.

Technically, the support for SIA is $10.89 and the next support is at $10.76.

It closed below the 100-day and 200-day Moving Average with high volume. Immediate resistance is at $11.04 and $11.13. The $11.20 resistance will be a strong resistance as it fails to break it before the result announcement.

Currently there is a limited price upside for SIA.

Thursday, 28 July 2016

UOB (U11) - 28 July 2016

UOB Q2 profit rises 5.1% to S$801 million. http://www.businesstimes.com.sg/companies-markets/uob-q2-profit-rises-51-to-s801m-bank-to-pay-out-s035-per-share

Technically on the weekly chart, the resistance is at $18.80 and $19.17.

The support can be seen at $18.51 and $18.31.

OCBC Bank (O39) - 28 July 2016

OCBC's Q2 net profit down 15% from a year ago. http://www.businesstimes.com.sg/companies-markets/ocbcs-q2-net-profit-down-15-without-geh-stake-sale-a-year-ago

Technically, the current price support is at $8.42 and the next support is at $8.24.

Resistance is currently at $8.56 and $8.66.

Updated on 08 Aug 2016

Monday, 25 July 2016

QT Vascular (5I0) - 25 July 2016

Loss-making QT Vascular say US appeals court overturns US$20 million payment to AngioScore

http://www.businesstimes.com.sg/companies-markets/qt-vascular-says-us-appeals-court-overturns-us20m-payment-to-angioscore

Stock price spiked up with high volume today but failed to break the $0.098 resistance. It closed below the 100-day Moving Average.

Current support is at $0.09 and $0.088 which seems to be a better entry price for trading.

In my opinion, this is a trading stock and not for investment.

Tuesday, 19 July 2016

Wilmar Intl (F34) - 20 July 2016

Wilmar expects to report a net loss of approximate US$230 million for 2Q16. http://www.businesstimes.com.sg/companies-markets/wilmar-warns-of-q2-loss

Technically, Wilmar gapped down today and opened below the 200-day Moving Average of 3.13. This has become the major resistance. The next resistance is about $3.18.

The current support is at about $3.08 and $3.00.

Friday, 15 July 2016

SMRT (S53) - 15 July 2016

Land Transport Authority (LTA) to buy S$1 billion of SMRT assets under new rail financing framework. http://www.straitstimes.com/singapore/transport/new-rail-financing-framework-9-things-to-know-about-agreement-between-smrt-and?xtor=EREC-16-2[ST_Newsletter_PM]-20160715-[New+rail+financing+framework%3A+9+things+to+know+about+agreement+between+SMRT+and+Govt]&xts=538291

SMRT is currently trading at 24.1x forward P/E. Pre-announcement, the street has 4 Buy, 5 Hold, and 4 Sell calls on the counter with consensus TP of $1.63.

SMRT will be reporting results on 28 Jul with management expected to shed more light on how the rail reform will affect its future performance and outlook. http://bit.ly/ketrade-smrt-20160715

SMRT shares were halted on 15 July 2016. Ex-Dividend of S$0.025 per share is on 18 July 2016.

The technical resistance is at $1.550 and the next resistance is at 1.570.

The price support is at $1.525 and $1.485.

Wednesday, 13 July 2016

Evolent Health Inc (NYSE:EVH) - 13 July 2016

Evolent Health Inc closed 19.65% higher today due to the acquisition of Chicago competitor for about US$145 million. http://www.bizjournals.com/washington/news/2016/07/13/evolent-health-to-acquire-chicago-competitor-for.html

My first initial coverage on this stock was on 01 June 2016 when it was at $15.75. This is a whopping 41.9% profit if the position was closed at $22.35.

Technically this stock builds a base before the next move up and consistently on the up-trend.

As the saying goes, the trend is your friend.

Subscribe to:

Comments (Atom)